BitMine Immersion’s Ether Holdings Top $6.6B, Stock Slides 7% Alongside ETH’s Tumble

The Tom Lee-led firm increased its ether stash to 1.5 million tokens last week, up from 1.15 million.

- BitMine’s ETH holdings surpassed 1.5 million ETH worth more than $6 billion.

- The stock’s lower by another 7% as ether continued to quickly pull back from its near record-high last wee.

- Rival ETH treasury company SharpLink (SBET) as well as Solana-focused names Upexi (UPXI), DeFi Development (DFDV) also traded lower.

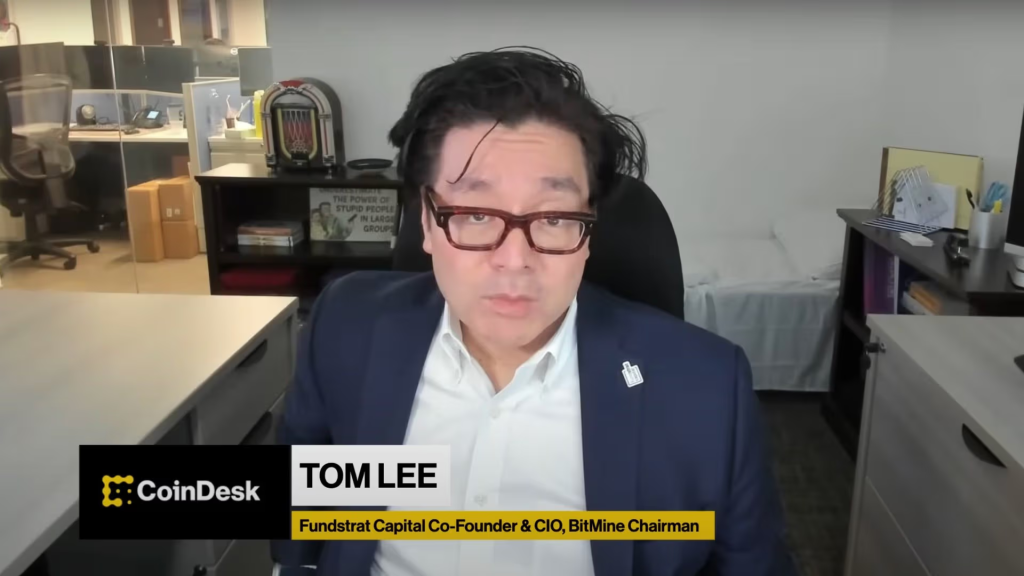

BitMine Immersion Technologies (BMNR), the listed firm with a digital asset treasury strategy focusing on Ethereum and led by Fundstrat’s Tom Lee, said in a Monday SEC filing that its holdings surpassed 1.5 million ether (ETH) worth roughly $6.6 billion.

With its latest purchase, it has become the second-largest public corporate cryptocurrency holder, surpassing miner MARA Holdings (MARA) and trailing only Strategy (MSTR), the original Treasury investment firm, which owns $72 billion worth of Bitcoin, according to Bitcointreasuries.net. Of course, Strategy, or MARA, is a holder of Bitcoin, while BMNR is an investor in ETH Treasury bonds.

BMNR was 7% lower Monday to $54 alongside a continuing pullback in ETH, which fell below $4,300, down 5% over the past 24 hours. It was less than one week ago when ether nearly touched $4,800 and was within a few dollars of a record high.

Other digital asset treasury companies also traded lower, extending their Friday plunge. ETH-focused SharpLink Gaming (SBET) was down 3%, while Solana-centric firms DeFi Development (DFDV) and Upexi (UPXI) were 9% and 6% lower, respectively.