Bitcoin bulls are back: Here’s what is needed for a rally to $120K

Bitcoin opened the week with a strong rally above $114,000, and these three developments could send BTC price back to its monthly range highs

- Clearer digital asset regulation, highlighted by this week’s high-profile SEC–CFTC roundtable, could strengthen investor confidence.

- A temporary resolution of the looming US government shutdown may ease risk aversion and boost Bitcoin price.

- Labor market data and Strategic Bitcoin Reserve expectations could fuel renewed momentum toward the $120,000 level.

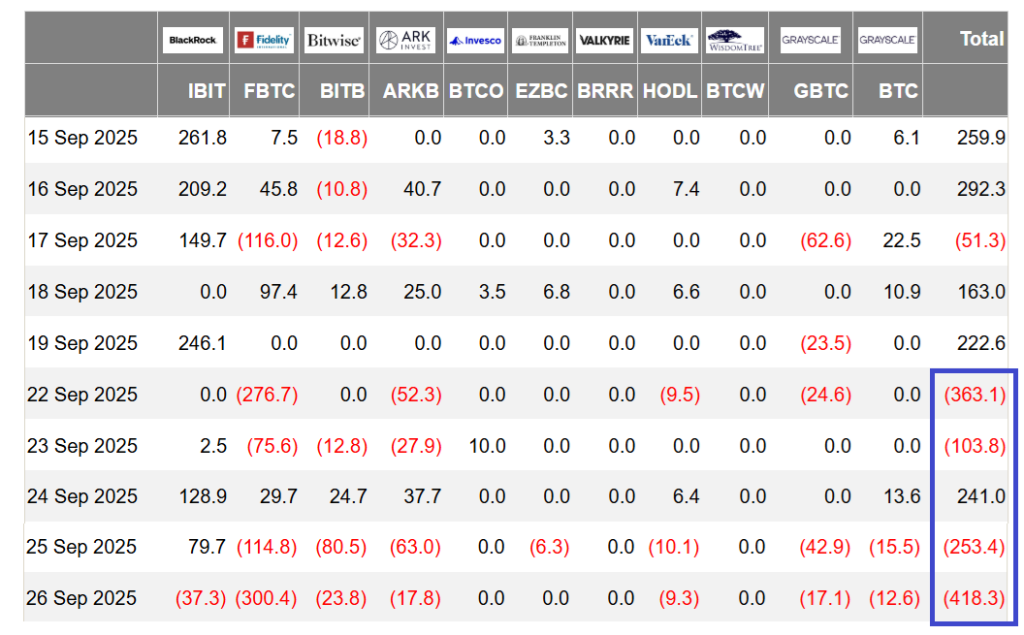

Bitcoin reclaimed the $114,000 mark on Monday, recouping part of the losses from the previous week. Interestingly, this rebound came despite heavy outflows from the spot Bitcoin exchange-traded funds (ETFs), prompting investors to question whether the rally is sustainable and what catalysts might drive Bitcoin toward the $120,000 level.

Another potential catalyst for Bitcoin’s price is the looming risk of a US government shutdown on Oct. 1. US President Donald Trump has scheduled a meeting with congressional leaders on Monday to try to avert the crisis. Without action from Congress, thousands of federal employees could be furloughed, and numerous services, including small-business grant programs, would be disrupted.

Bitcoin’s price has historically reacted negatively when traders become more risk-averse. About $1.7 trillion in “discretionary” spending that funds agency operations is set to expire at the end of the fiscal year on Tuesday. The House of Representatives narrowly approved a bill on Sept. 19 to fund government agencies through Nov. 21, leaving final approval now in the Senate’s hands.

The next major factor that could unlock a Bitcoin rally to $120,000 is the US job market data, the Federal Reserve’s top focus following core inflation that matched market expectations at 2.9% in August. The US Bureau of Labor Statistics is scheduled to release the JOLTS survey of job openings on Tuesday, followed by the nonfarm payroll report on Friday.

Signs of weakness in the labor market could steer investors toward assets viewed as safer, such as gold and short-term government bonds.

US Strategic Bitcoin Reserves hopes create a psychological support

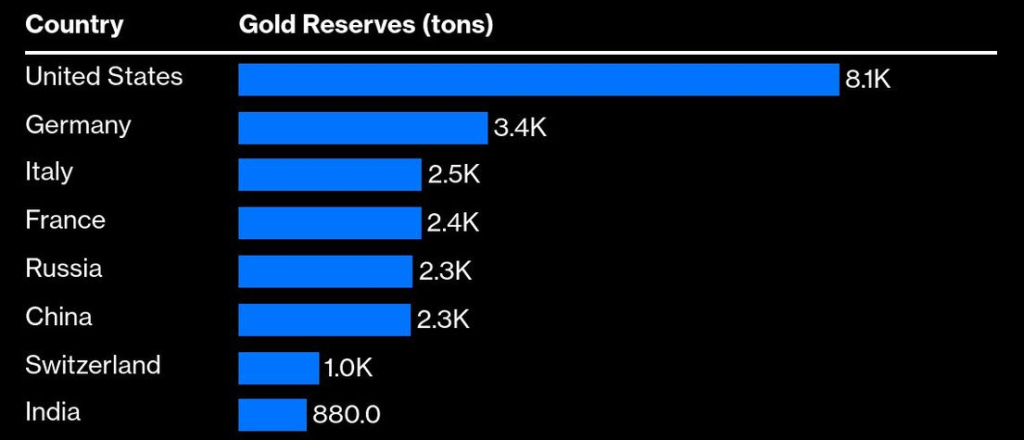

Another reason Bitcoin has managed to hold the $109,000 level is optimism surrounding plans for a United States Strategic Bitcoin Reserve. Jan3 founder Samson Mow recently noted that the Trump administration is “pushing forward” budget-neutral strategies to acquire Bitcoin. Some analysts also highlight the possibility of a reevaluation of the US Treasury’s gold reserves.

By repricing gold’s official value from the $42.22 level set by Congress in 1973, the US Treasury could potentially unlock nearly $1 trillion in credit, though US Treasury Secretary Scott Bessent has dismissed speculation of such a move. Even so, analysts remain confident in the government’s ability to successfully launch a Strategic Bitcoin Reserve in the coming months.

Key drivers that could push Bitcoin above $120,000 include clearer regulation across the digital asset industry, a temporary agreement to avert a looming US government shutdown, and reduced risks reflected in upcoming US job market data. Meanwhile, even the possibility of the US Treasury adding Bitcoin to its reserves provides a psychological support level for the market if those broader events turn unfavorable.