Wall St advances after Fed minutes show division on worries about jobs, inflation

- Indexes up: Dow 0.14%, S&P 500 0.56%, Nasdaq 0.98%

- Dell climbs after multiple price target hikes

- US-listed shares of gold miners jump

- Joby Aviation descends on pricing stock offering

Technology shares gave Wall Street a boost on Wednesday as investors, lacking economic data during the government shutdown, looked to minutes from the Federal Reserve’s most recent policy meeting for clues to the outlook for interest rate cuts through year-end.

All three major U.S. stock indexes were higher, with the tech-laden Nasdaq out front, boosted by the artificial intelligence-related megacaps that have led market gains so far this year. The S&P 500 and the Nasdaq appeared on track to eke out new all-time closing highs.

Chip stocks (.SOX), were clear outperformers, while energy (.SPNY), consumer staples (.SPLRCS), and homebuilders (.SPCOMHOME), as a report from the Mortgage Bankers Association showed home loan demand dipped 4.7% last week despite easing interest rates.

“One of the biggest drivers of the markets this year is clearly technology and the AI story,” said Lara Castleton, U.S. head of portfolio construction and strategy at Janus Henderson Investors. “It continues to make a bunch of headline news … like it’s just encompassing everything.”

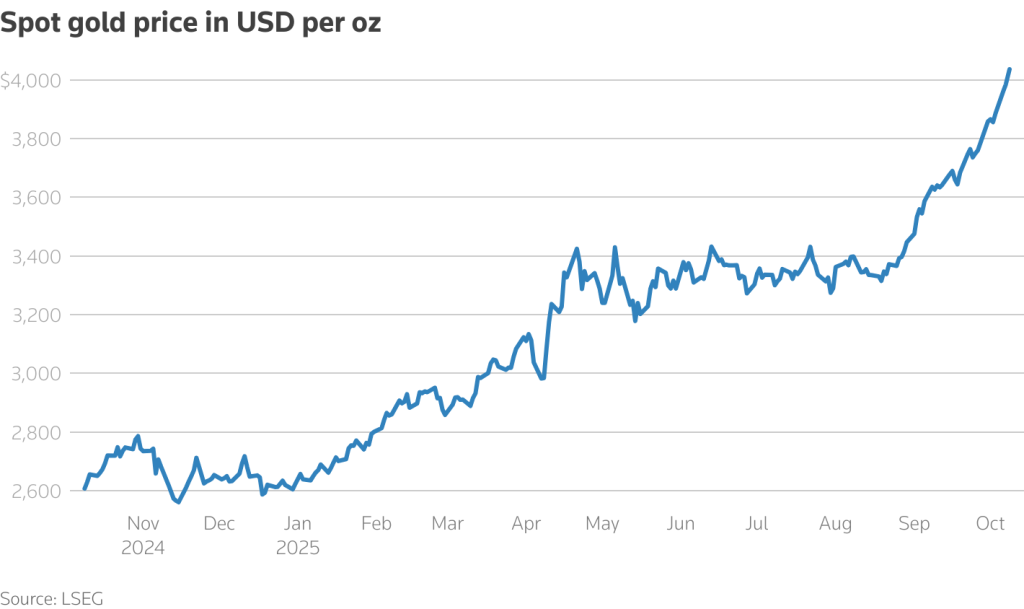

Amid continuing euphoria surrounding AI, mounting U.S. and geopolitical uncertainty has pushed gold prices above the $4,000 per ounce threshold as investors flock to the safe-haven metal as a hedge against growing risks.

The U.S. government shutdown entered its eighth day, and a congressional stalemate appeared to suggest market participants will have to make do without official economic indicators for the immediate future, leaving markets with little to go on until third-quarter earnings season kicks off next week.

In the absence of that data, investors looked to third-quarter earnings season to get underway next week and the minutes from the September meeting of the Federal Open Markets Committee (FOMC) for clues as to the central bank’s intentions regarding interest rate cuts.

Those minutes showed a divided committee, in which policymakers were concerned about rising labor market risks but remained wary of inflation. And while “most judged that it likely would be appropriate to ease policy further over the remainder of this year,” the timing and pace of further moves remained an open question.

“The topical discussion is about the extent of Fed cuts and how restrictive or not policy is,” said Zachary Hill, head of portfolio management at Horizon Investments in Charlotte, North Carolina. “More broadly, the Fed is definitely not in a great position without public sector economic data as (the shutdown) continues to drag on, which really just makes policymakers’ already challenging job even tougher.”

Financial markets are currently pricing in a fairly certain 92.5% likelihood that the Fed will lower the Fed funds target rate by 25 basis points at the conclusion of this month’s policy meeting, which is set to occur on October 29.

The Dow Jones Industrial Average (.DJI),

rose 69.39 points, or 0.14%, to 46,669.64, the S&P 500 (.SPX), gained 37.97 points, or 0.56%, to 6,752.43 and the Nasdaq Composite (.IXIC), gained 223.40 points, or 0.98%, to 23,011.76.

Among the 11 major sectors of the S&P 500, tech shares (.SPLRCT), led the gainers, while energy stocks (.SPNY), had the steepest percentage loss.

Datadog (DDOG.O), rose 5.3% after Bernstein raised its price target on the cloud security firm, while Intercontinental Exchange ICE.N, opens new tab fell 2.2% after Barclays cut its price target on the stock.

Fair Isaac Corp (FICO.N), fell 8.5% after credit bureau Equifax (EFX.N), said it plans to offer cheaper mortgage credit scores.

Surging gold prices helped U.S.-listed shares of gold miners Newmont (NEM.N), and Gold Fields gain 1.1% and 3.5%, respectively.

Dell (DELL.N), rose 7.7% after multiple brokerages raised their price targets for the stock.

Freeport-McMoRan (FCX.N), advanced 5.2% in the wake of Citigroup’s upgrade to “buy” from “neutral”.

Joby Aviation (JOBY.N), declined 8.9% after the electric air taxi maker on Tuesday priced a $514 million share sale at a 10.9% discount to its last closing price.

AMD (AMD.O), jumped 10.9%, extending its gains for the third day. The chipmaker’s shares have surged over 42% this week.

Advancing issues outnumbered decliners by a 1.77-to-1 ratio on the NYSE. There were 353 new highs and 61 new lows on the NYSE.

On the Nasdaq, 3,014 stocks rose and 1,594 fell as advancing issues outnumbered decliners by a 1.89-to-1 ratio.

The S&P 500 posted 33 new 52-week highs and 4 new lows while the Nasdaq Composite recorded 119 new highs and 55 new lows.