Mizuho boosts AMD price target on OpenAI deal

Mizuho raised its price target on Advanced Micro Devices to $275 from $205 after a multibillion-dollar supply deal with OpenAI that could lift revenue and profit sharply over the next five years, even as it warned of investor concerns about funding and spending circularity in Ai.

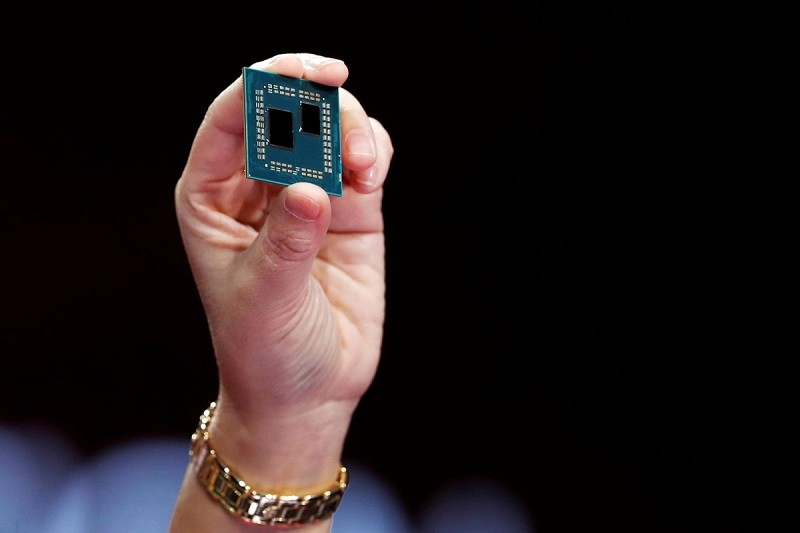

AMD’s agreement with OpenAI covers six tranches of chip supply totaling 6 gigawatts of compute power from late 2026 through 2030.

Mizuho estimated the deal’s value at more than $90 billion through 2030, with as much as $22 billion in annual revenue by the end of the decade.

The contract includes about 160 million warrant shares tied to AMD’s stock price and deployment milestones, which could dilute margins by more than 300 basis points but still deliver strong earnings growth.

Mizuho forecast AMD’s earnings per share could double by 2027-28, supported by the OpenAI orders, and said the stock now trades at about 30 times projected 2027 earnings.

It raised estimates for Nvidia and its price target modestly to $225, while keeping Broadcom at $410.

Though investors are increasingly worried about the sustainability of AI capital spending.

OpenAI may require as much as $700 billion in compute investment to meet its 2030 revenue target of $200 billion, leaving what it sees as a $130 billion funding gap.

“Circularity” concerns, where revenue growth depends on continued heavy spending, remain a risk.

“We continue to see AVGO, NVDA best-positioned while AMD’s OAI deal suggest upside potential”

Despite AMD’s recent strong performance in traditional servers, its AI accelerator business continues to lag behind Nvidia’s CUDA software ecosystem. Analysts expect limited new orders for AMD’s MI355 chip until 2026, though the company plans to outline its strategy at its analyst day on November 11th.

Broadcom also reached an agreement with OpenAI to develop and deploy 10 gigawatts of custom AI accelerators, sending its stock up 12% on Monday.

AMD shares rose about 2%.