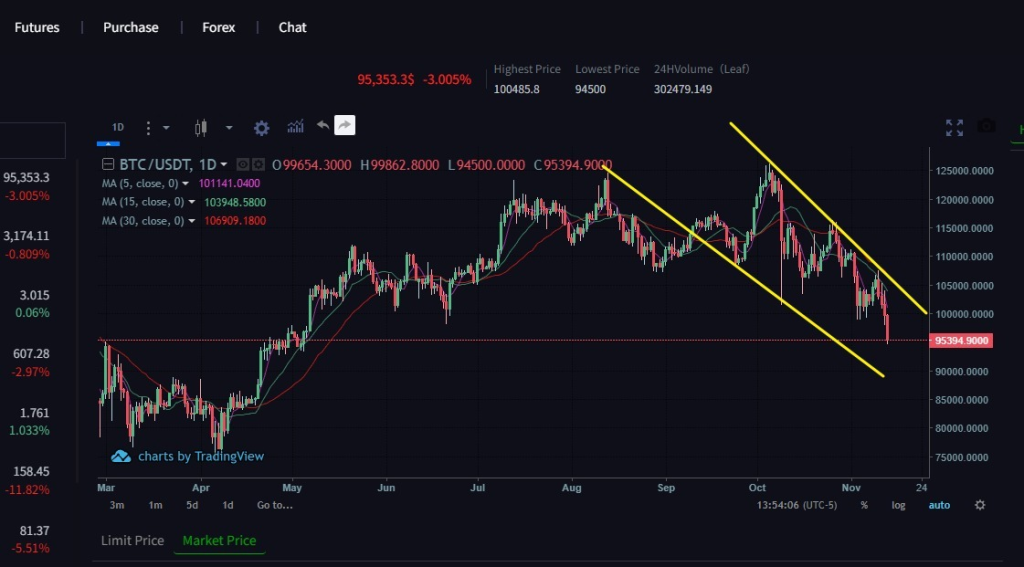

Bitcoin Trend Analysis Today

Bitcoin is currently priced at $86,900. The BTC market is currently in a state of uncertainty due to both technical factors and the external environment. Key support is around $80,600, and resistance is around $88,885. Moving averages are in a bearish alignment, but short-term momentum is weakening, and the moving averages are flattening, suggesting the market may be entering a period of observation. On the daily chart, bulls and bears are battling, with the price fluctuating and falling back near the highs. The MACD indicator on the 2-hour chart shows that bears dominate in the short term; however, the uptrend on the daily chart has not been completely broken. Currently, the market may fluctuate within a range, and the recommended strategy is to short at higher levels and long at lower levels